Feb. 28, 2022 Massachusetts

Will the Bubble Pop?

Will the housing bubble finally pop? When will the housing market crash?

Everyone wants to know for their own reasons — whether it's to exit the market, to prepare and safeguard investments, or to finally be able to invest in the market since the housing prices are so high right now.

Upfront disclaimer: No one has a crystal ball to predict the next crash of the market. That being said, there are key indicators that allow investors to speculate on what will happen next in the market.

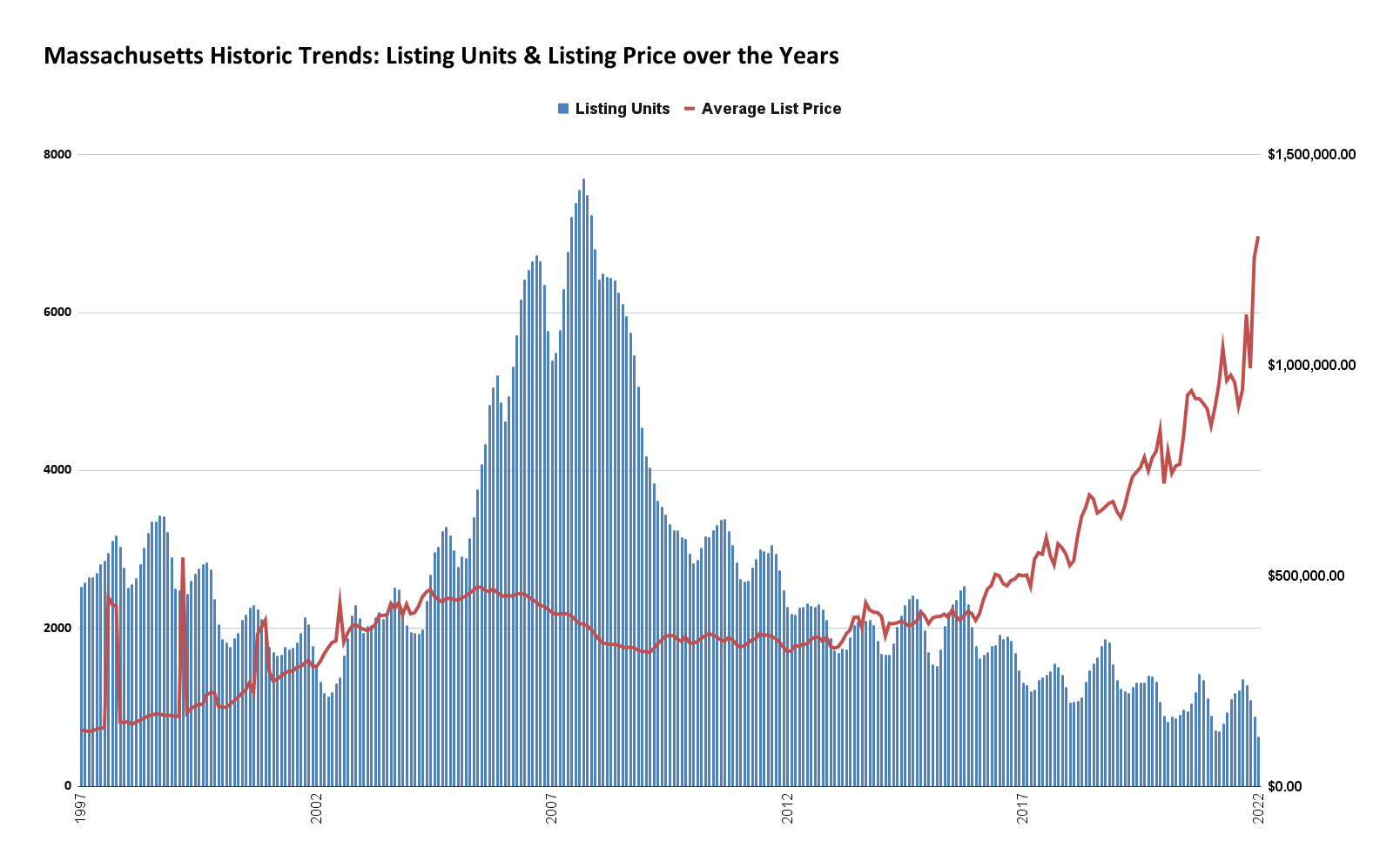

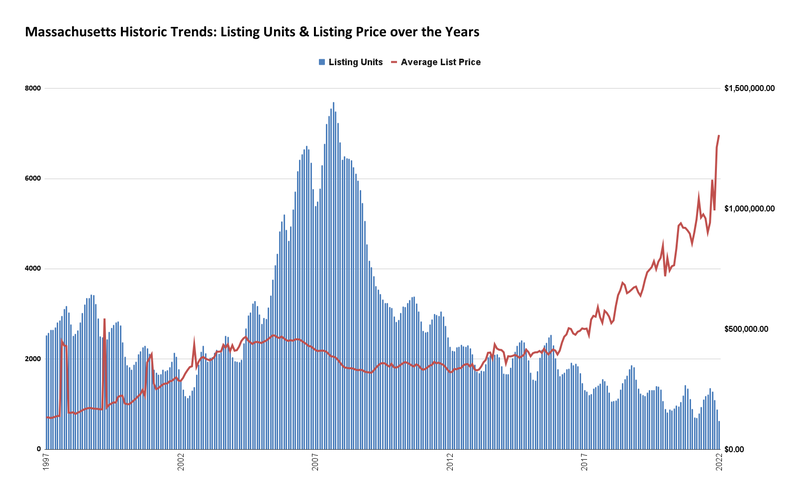

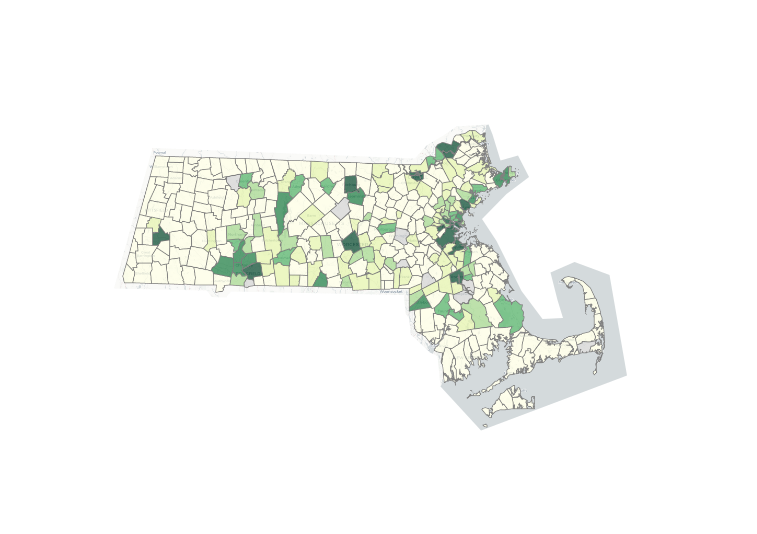

The last market crash around 2007 can be visualized below. The figure shows only multi-family properties in Massachusetts. There was a large listing volume at the time, and list prices dropped significantly by over 30% across the state. In comparison, today there is historically low listing volume with historically high listing prices and sale prices.

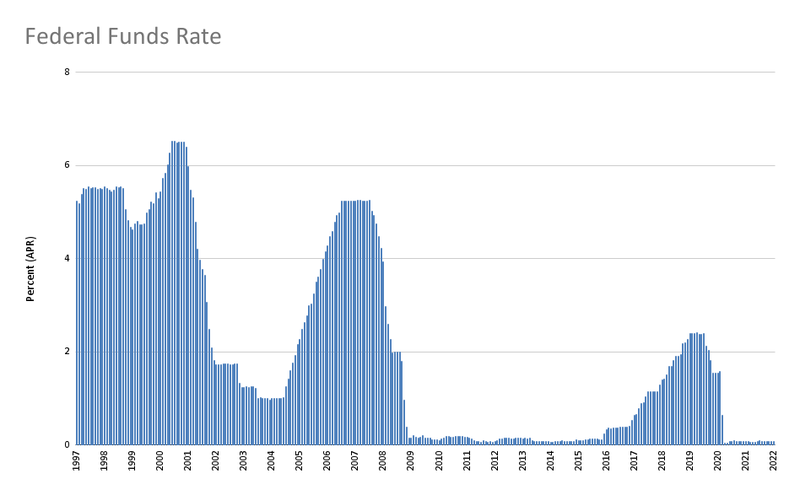

Federal Funds Rate

As opposed to the market popping, my opinion is that the market will cool. This is dependent on the Federal Reserve slowly raising rates. What does this actually mean? The Federal Funds Rate is the rate at which banks can borrow and lend money to other banks. A more in-depth explanation can be found on Investopedia. While this rate is not the rate that us as consumers can borrow at, this rate affects how much the banks are willing to charge the consumer for interest. Ultimately, this rate can affect and change the mortgage rate indirectly. Seen below, the Federal Funds Rate is virtually zero. This has led to very low interest rates over the last few years, causing a lot of “free money” to enter the market. As this rate increases, mortgage rates will begin to increase. Ultimately, less ‘house’ can be afforded with the same monthly mortgage payment, lowering what makes sense financially to purchase houses for.

Summary:

While I expect the market to cool down due to the rise in mortgage rates, this will be directly opposed by the low volume and high demand market we currently face. On top of that, rents have continued to increase over the past several years due to high demand for rentals . These additional factors will delay the cool-down until they cannot be maintained any longer, eventually finding market equilibrium and plateauing.

Comments