Feb. 7, 2022 Massachusetts

Real Estate vs Stocks

When it comes to investing, there are many different options and it can become hard to decide on the best course of action. Stock investing and real estate investing are two very prominent choices for long-term and even short-term investing. In both of these categories, there are multiple strategies to act upon that require different levels of passive to active engagement. For the sake of this article, I will only be looking at appreciation of the asset itself and the resulting return on investment (ROI).

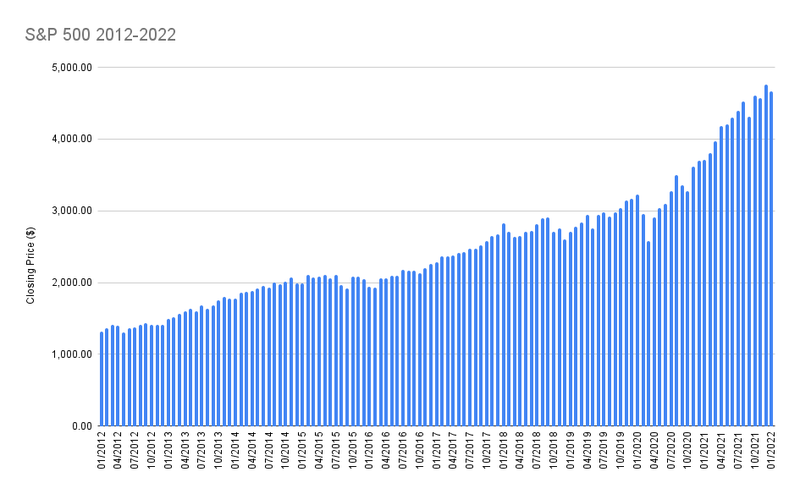

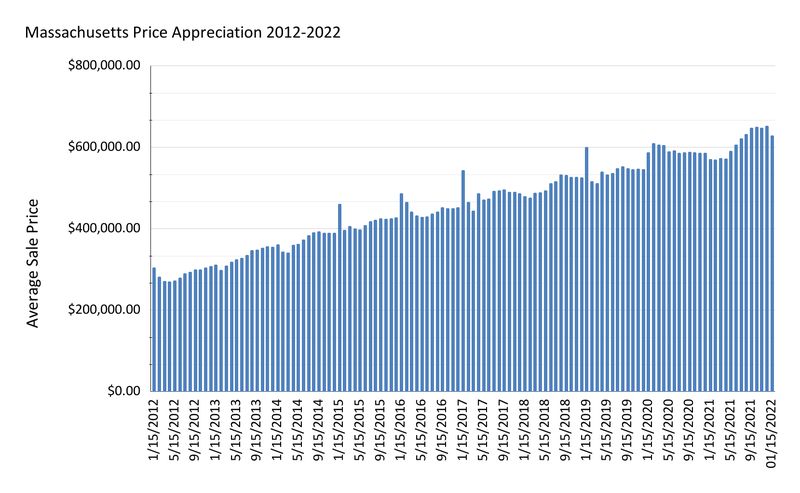

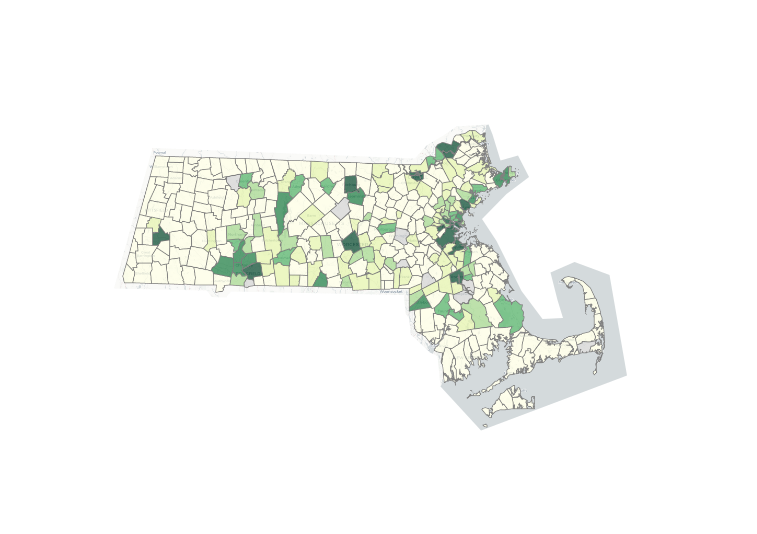

Below are two graphs that show the appreciation of the stocks involved in the S&P 500 (a commonly invested index of 500 large U.S. companies) and the appreciation of the multi-family housing market in Massachusetts. Historically over the last 10 years, while there have been occasional dips or losses, both stocks and real estate have increased in value substantially over the long term.

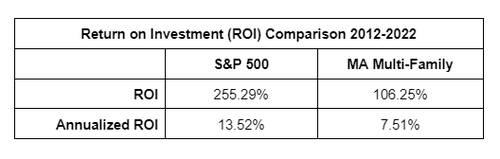

When directly comparing the purchase of 1 stock of S&P versus 1 average Massachusetts multi-family, the ROI of the stocks is nearly double that of the real estate. However, this is only the case if you buy the property with a 100% down payment. Real estate allows the investor to procure a property with leverage (e.g. a mortgage loan with the physical property as collateral).

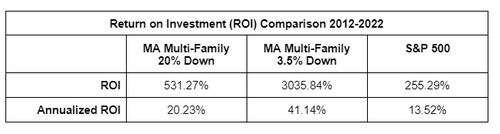

Below are a couple of examples of very common down payment percentages for investors. A 20-30% down payment is common for pure investment properties, while a down payment of 3.5% is possible on multi-family properties if you plan to live in the property for at least a year. The annualized returns quickly overtake that of normal stocks due to the power of leverage.

While investing in real estate in this manner is usually not as passive as buying an index fund of stocks and forgetting it, the purpose of this article is to visually show the difference in ROI that real estate can create due to the U.S.’s mortgage system. In this example, other factors of income were not taken into account, including rental cash flow, tax depreciation, and other methods to push tax realization. However, when investing, these factors should be considered. By borrowing money from banks and other institutions in a relatively safe manner, such as through a mortgage, real estate investors are able to compound their original investment in a more effective manner than with other investing options.

Comments