Oct. 11, 2022

Estimating Cap Rates

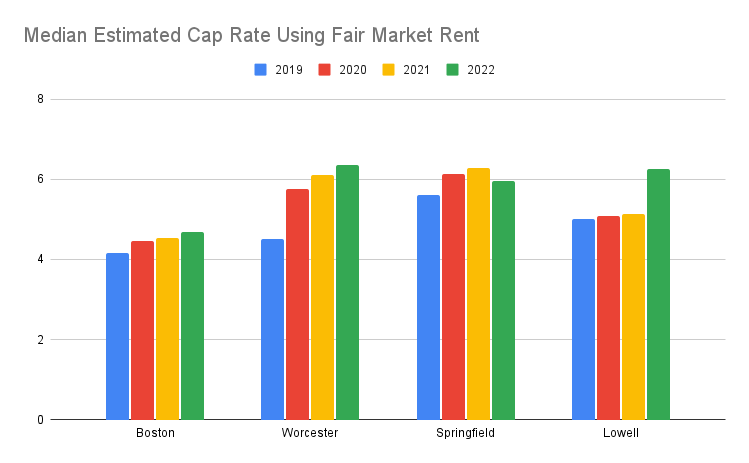

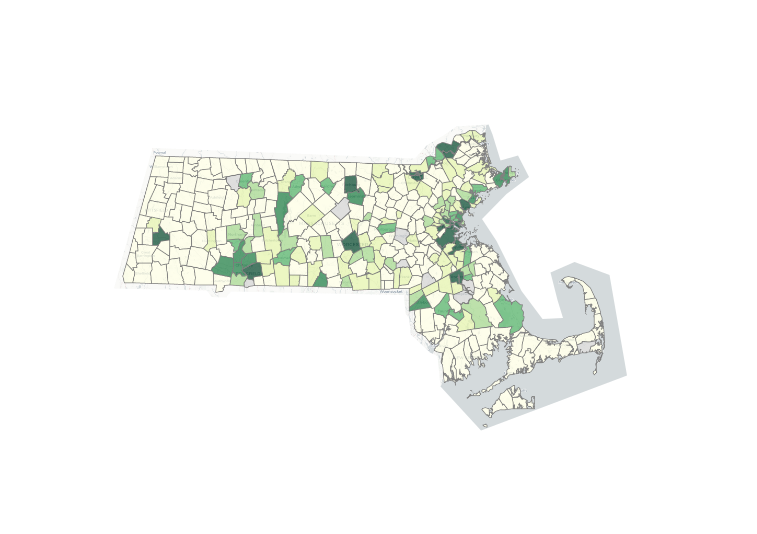

Estimating Cap Rates of Major Multi-Family Markets

In the past I've used bots to quickly calculate estimations of the well known 1% rule for all new properties that hit the MLS and that were sent from my real estate agent to my email. I did this to not waste my time on properties that made no sense to look at and save my time.

I took this idea to generate this data, but with a bit larger scale! This data comes from all MLS sold properties for these 4 cities over the last 4 years. That being said, the data isn't perfect. If you've seen a lot of MLS listings, you will know to almost never trust how accurate some information added into the listing is. One of those major pieces used to calculate a cap rate is the rent role. To remedy this issue I assume the values given in the Department of Housing and Urban Development (HUD) fair market rents (FMR). These rents can be used by investors to get a quick idea of what you can get for rent, but usually on the lower end, especially in a market with lower volumes (Massachusetts).

Assumptions:

Rent = HUD Fair Market Rents

Electricity =$50/unit

Water/Sewer = $50/bedroom

Insurance = $150/Unit

Repairs = 5% Rents

Management = 10% Rents

Vacancy = 5% Rents

Disclaimer:

Of course every property should be analyzed individually and the values I used above will never be accurate for everything. Using this wag you can see relative trends in cap rate of these 4 major cities based on the changes in price and rent over the years.

Comments